Reimbursement Management

Reimbursement Management

Managing reimbursements doesn’t have to be chaotic. Beehive HRMS Reimbursement Management streamlines the entire process. From claim submission to payroll integration, it ensures 100% policy compliance, zero errors, and real-time visibility.

Be it general business expenses or tax-saving CTC-based components, Beehive HRMS eliminates the manual work and guesswork from every step.

Be it general business expenses or tax-saving CTC-based components, Beehive HRMS eliminates the manual work and guesswork from every step.

Make CTC-Based Reimbursements Seamless and Accurate

Delayed payments, policy confusion, and non-compliance can frustrate employees and make your business bleed money.

Manual Reimbursement is Costing You

Endless Chasing

Finance teams spend hours each month tracking receipts, clarifying policy, and reprocessing claims.

Loss: Valuable time is drained each month on low-value tasks.

Loss: Valuable time is drained each month on low-value tasks.

Frustrated Employees

Employees lose tax benefits or wait weeks for reimbursement—leading to low trust and satisfaction.

Impact: Most reimbursement queries can be avoided with better systems in place.

Impact: Most reimbursement queries can be avoided with better systems in place.

Policy Violations and Tax Risk

Unvalidated claims lead to inaccurate Form 16 entries and compliance gaps.

Risk: Tax penalties and audit corrections can lead to major yearly setbacks.

Risk: Tax penalties and audit corrections can lead to major yearly setbacks.

Spreadsheet Dependency

Disconnected processes across finance and HR create reconciliation errors and missed payouts.

Consequence: Payroll cycles and month-end close are often delayed, disrupting operations.

Consequence: Payroll cycles and month-end close are often delayed, disrupting operations.

Here’s What You Need

Beehive HRMS Reimbursement Intelligence

A unified reimbursement system that handles both business expense claims and structured CTC components—integrated directly into payroll.

For General Reimbursements

01

Snap, Validate & Submit

Employees upload bills via mobile or desktop, with auto-categorization and smart validation for mileage, caps, and duplicates.

Ease: 78% faster processing and an 89% drop in policy violations.

Ease: 78% faster processing and an 89% drop in policy violations.

02

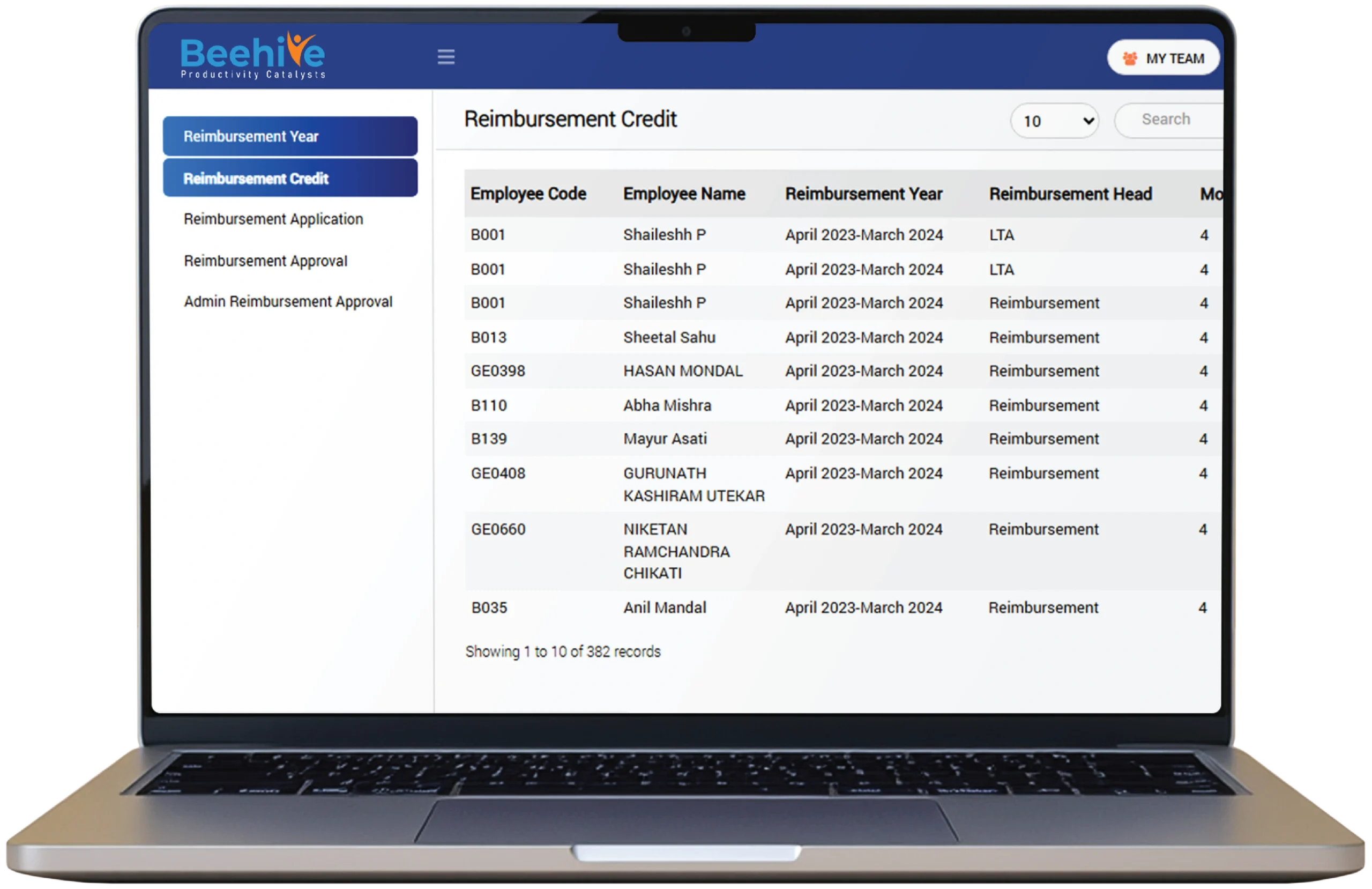

Configurable Workflows & Dashboards

Set claim cycles monthly or quarterly, while managers and finance track claims, exceptions, and payouts in real time.

Control: Zero missed submissions and 60% faster claim closure.

Control: Zero missed submissions and 60% faster claim closure.

03

Seamless Payroll Integration

Approved reimbursements flow directly into payroll with complete accuracy and tax-readiness.

Efficiency: 94% improvement in sync and reporting accuracy.

Efficiency: 94% improvement in sync and reporting accuracy.

For CTC-Based Reimbursements

05

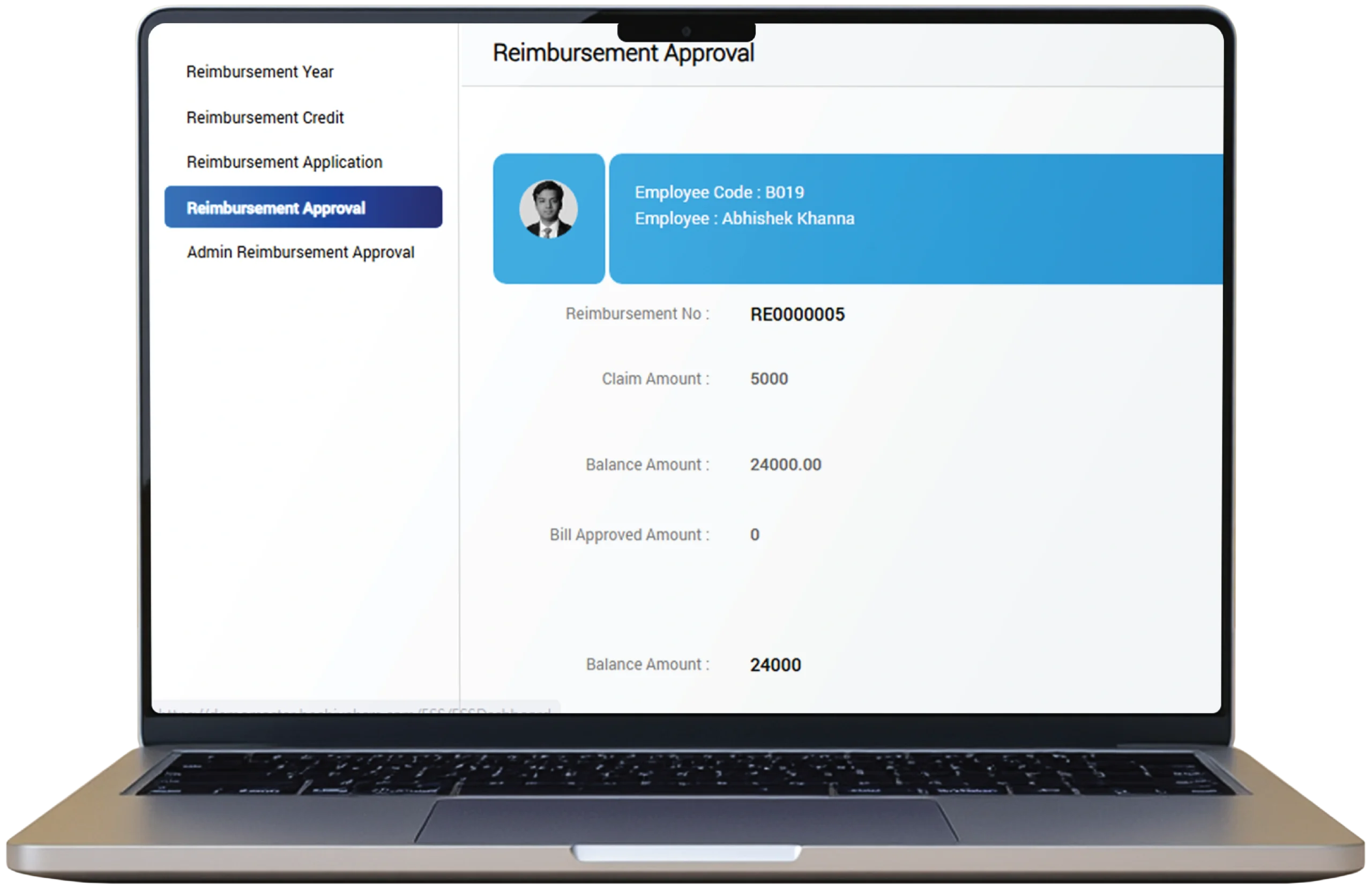

Real-Time Eligibility & Self-Service

Claims are auto-validated against limits (e.g., 2 LTA in 4 years) with employees tracking status, reminders, and payslip exemptions via portal.

Outcome: No more overclaims, with valuable hours saved for every employee.

Outcome: No more overclaims, with valuable hours saved for every employee.

One Platform for ZERO Headaches

Beehive Reimbursement Management removes friction from employee claims—whether operational or CTC-based. This results in faster reimbursements, better tax outcomes, and fewer HR-finance escalations.

Simplify Reimbursements with Automated, Tax-Smart Workflows

Beehive HRMS streamlines employee reimbursements—from fuel to LTA—with automated claim rules, policy alignment, and payroll integration. By digitizing every claim and linking it to structured CTC, it reduces manual work, ensures compliance, and maximizes employee tax savings.

FAQ

What is Reimbursement Management in Beehive HRMS?

It automates CTC-based employee reimbursements like fuel, medical, internet, and LTA claims under salary structures.

Accordion ContentHow does CTC-based reimbursement work?

Employees are allocated reimbursement limits as part of their CTC, and claims are adjusted within that budget.

What is a Flexi Basket in reimbursements?

Flexi Basket allows employees to choose reimbursement heads (like fuel, meal, travel) as per their lifestyle and tax planning.

Can employees submit bills digitally?

Yes, employees can upload receipts and bills through the self-service portal or mobile app.

How does HR ensure claim accuracy?

Beehive follows a maker-checker workflow, where claims are submitted by employees, verified by managers, and approved by HR/finance.

Are reimbursements tax-compliant?

Yes, the system automatically validates claims against tax rules, ensuring compliance and correct exemptions.

Can reimbursements be linked to payroll?

Yes, approved reimbursements directly integrate into monthly payroll for hassle-free disbursement.

Streamline Claims, Strengthen Compliance and Elevate Employee Experience.

Let’s talk.

* Results based on aggregated customer feedback and may vary by organization.