Payroll Management

Payroll Management

It is critical because nothing erodes trust faster than late, wrong, or confusing paychecks.

Payroll That Protects Data, Ensures Compliance, & Builds Trust

Broken Payroll Processes Are Costing You

Manual Madness

Cost: Overtime, reprocessing, and escalations add up to heavy annual expenses.

Compliance Roulette

Impact: Each incident carries heavy penalties, adding to compliance and financial strain.

Lack of Control

Risk: Undetected errors slip through each month, leading to avoidable financial losses.

Zero Flexibility

Loss: Compensation satisfaction falls sharply, along with payroll accuracy.

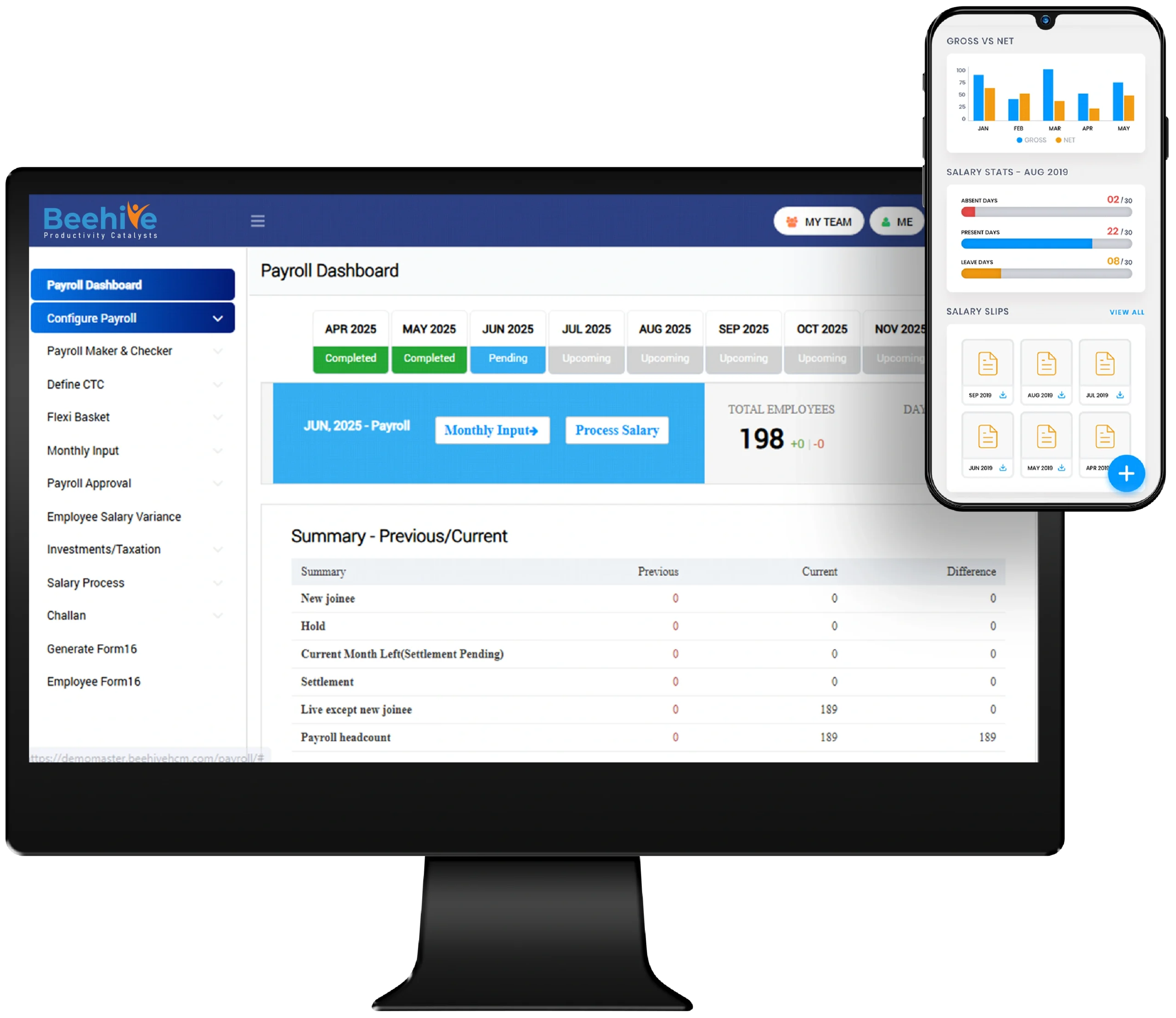

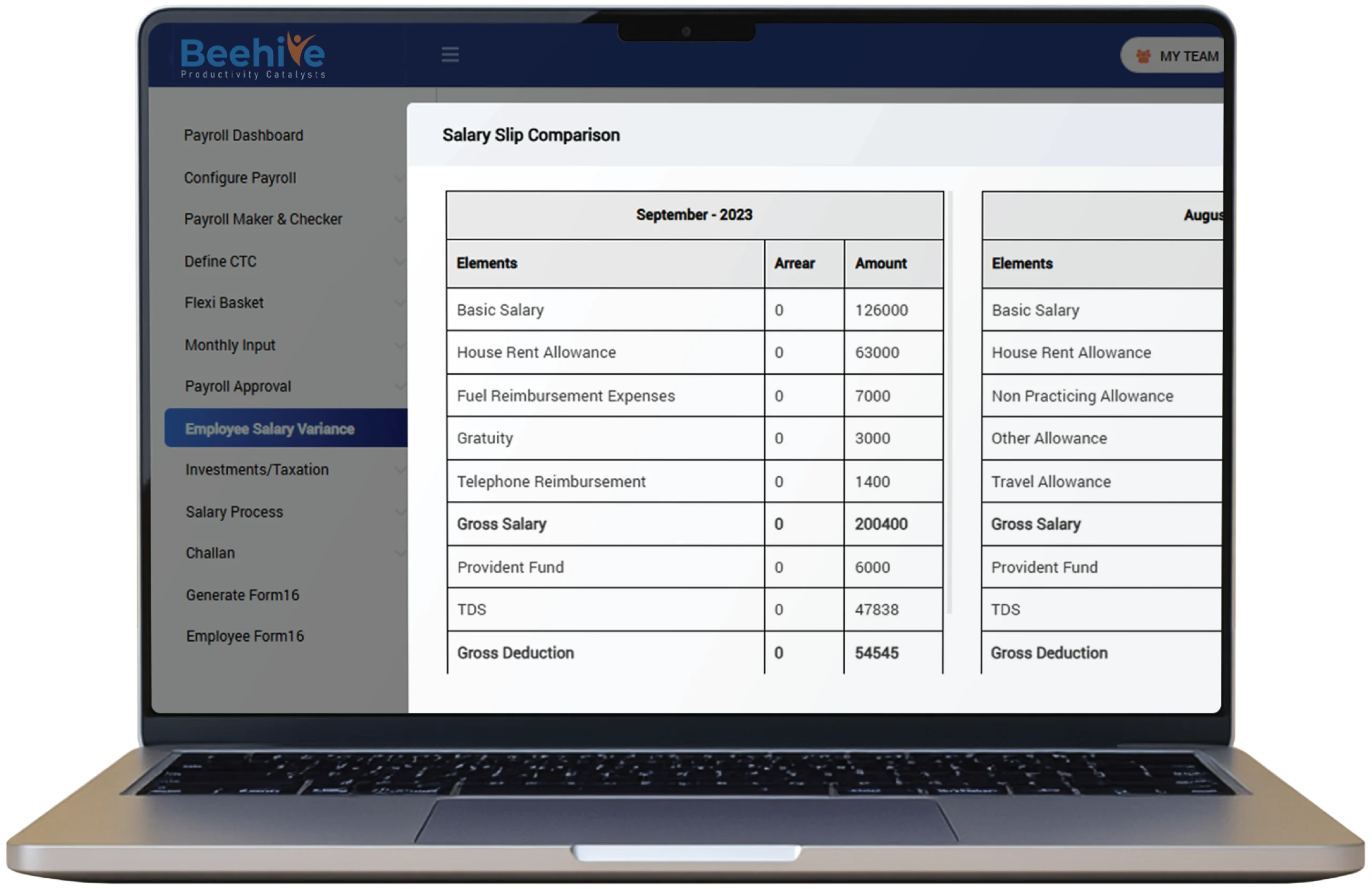

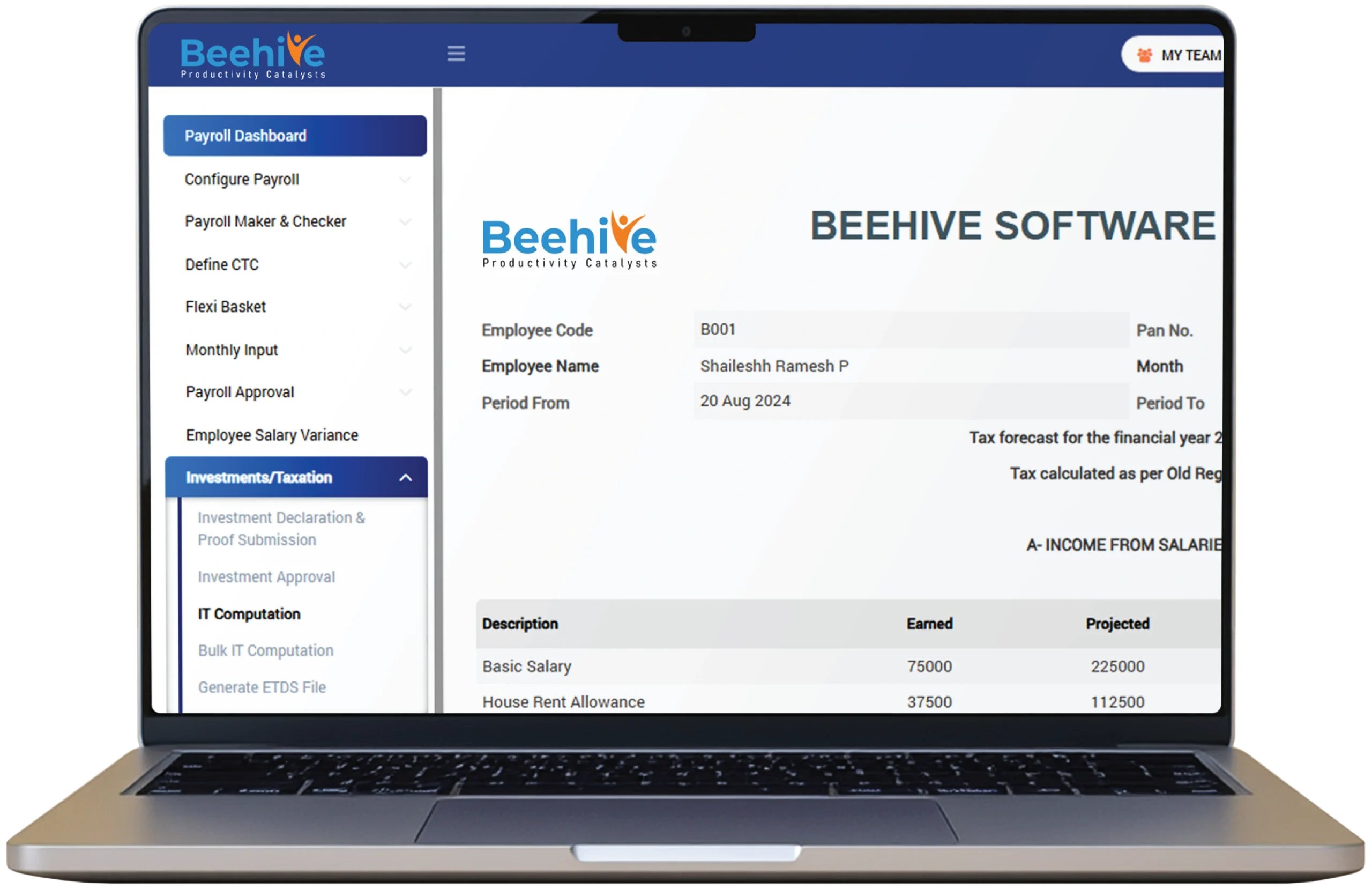

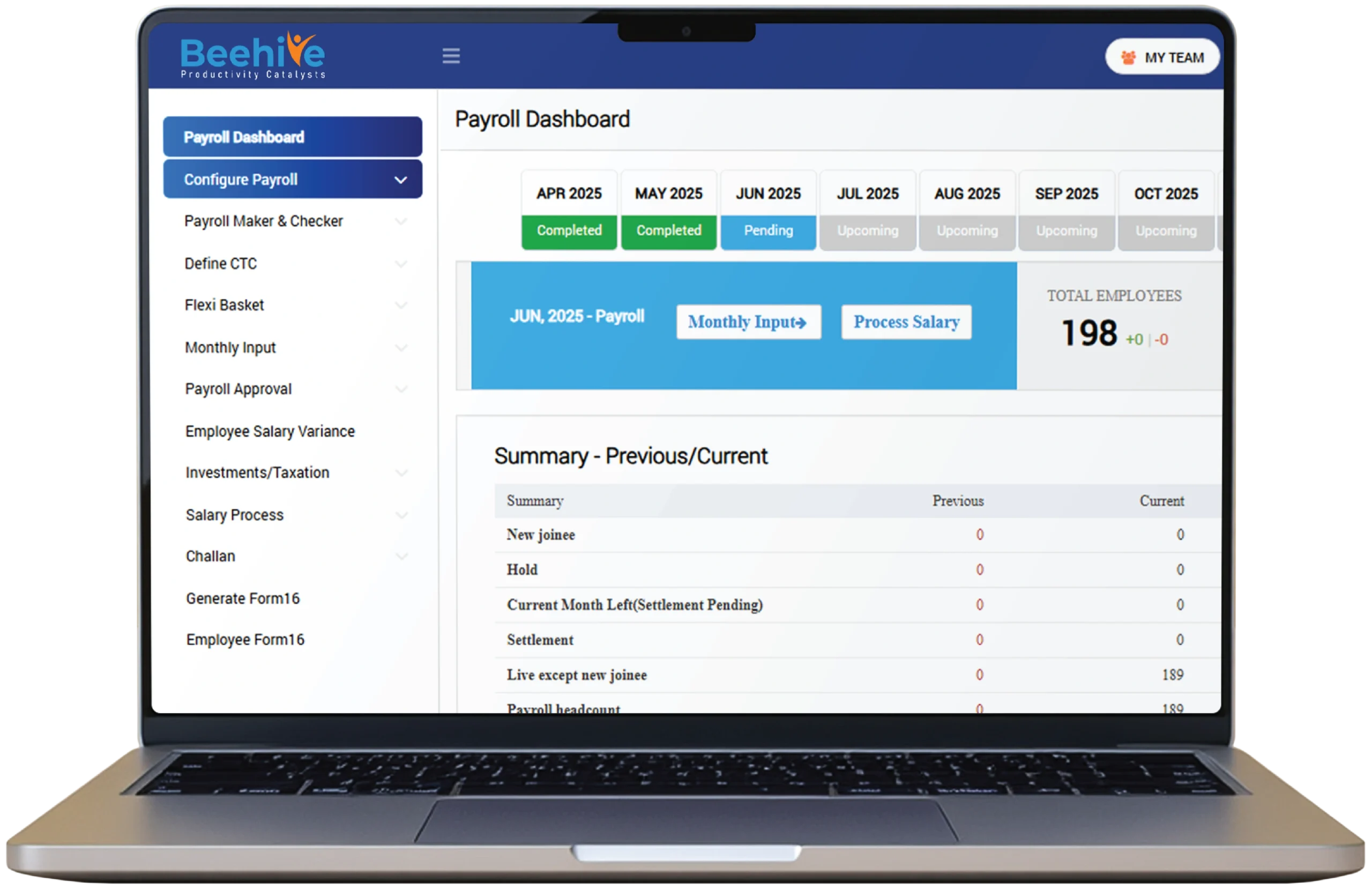

Beehive HRMS Payroll Intelligence

and secure the entire payroll lifecycle.

01

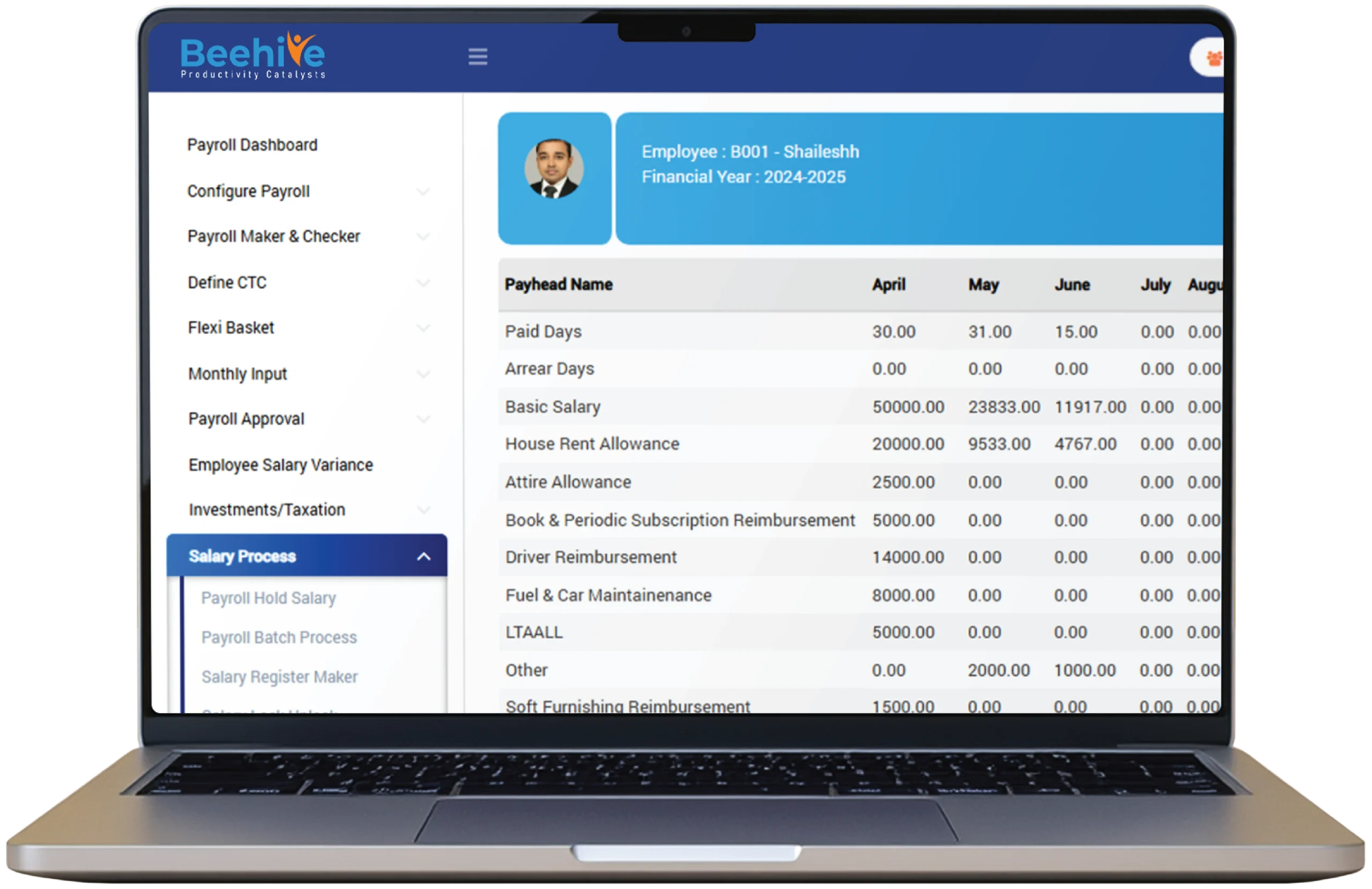

Automated Payroll Processing

Efficiency: 85% reduction in processing time.

04

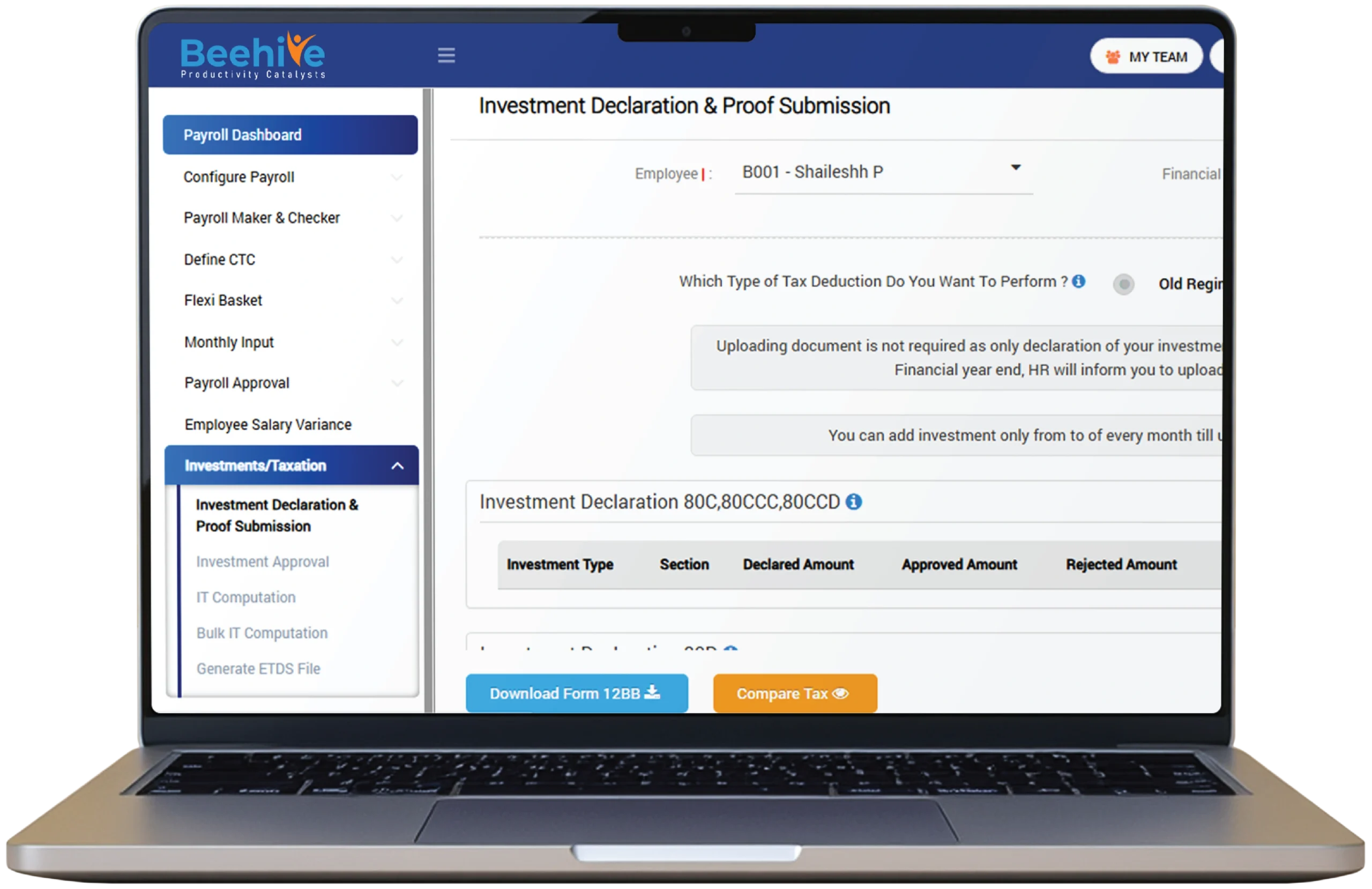

Reimbursements & Flexi Benefits

Engagement: 45% increase in compensation satisfaction.

07

Full & Final Settlements

Accuracy: 99.9% correct FnF payouts.

Put Payroll on Autopilot Without Losing Control

Run Payroll with 100% Accuracy and Zero Stress

FAQ

What is Payroll Management in Beehive HRMS?

Beehive Payroll automates salary processing, tax compliance, and payouts with accuracy and transparency.

How does the maker-checker process work in payroll?

Payroll inputs follow a maker-checker system where one team enters data and another verifies it, ensuring error-free processing.

Can payroll handle statutory compliance?

Yes, Beehive ensures PF, ESI, TDS, PT, and labor law compliance with automated calculations and filings.

Does it integrate with attendance and leave?

Yes, payroll syncs with attendance, overtime, leave, and shift data for accurate payouts.

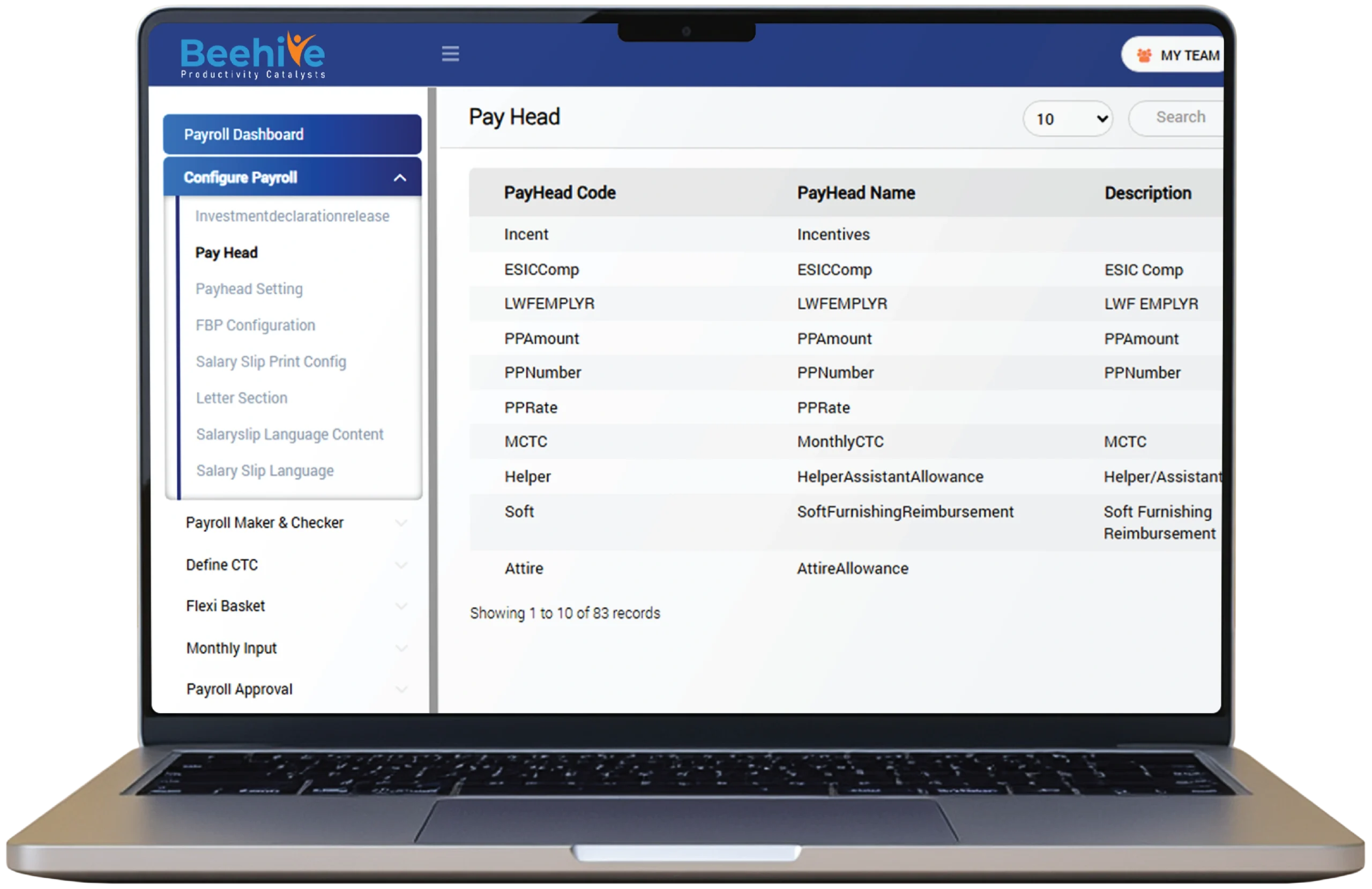

Can payroll be customized for complex salary structures?

Yes, Beehive supports flexible salary components, allowances, deductions, and flexi basket plans.

How secure is payroll data in Beehive HRMS?

Payroll data is encrypted and access-controlled to protect sensitive employee information.

Does it support multi-location payroll?

Yes, payroll can be processed across branches, locations, and entities from a centralized platform.

Stop Fighting & Start Forecasting.

* Results based on aggregated customer feedback and may vary by organization.