Loans & Advances Management

Loans & Advances Management

Salary advances and employee loans are not the problem, but manual tracking is. Beehive HRMS Loans & Advances Management eliminates spreadsheets, reconciliation errors, and missed deductions by embedding the entire process within payroll.

Get rid of guesswork and disputes and back them with policy, audit-ready loan automation that works.

Get rid of guesswork and disputes and back them with policy, audit-ready loan automation that works.

Loans & Advances Made Accurate, Transparent, & Stress-Free

Loan recovery is less about excel skills and more about compliance, transparency, and employee trust. Manual processes are failing you on all three.

Inefficient Loan Management Is Costing You

Double Deductions, Missed Recoveries

Manual EMI tracking leads to overcharges, missed stop-dates, and payroll reworks.

Loss: HR time, payroll errors, and trust gaps add up to major yearly setbacks.

Loss: HR time, payroll errors, and trust gaps add up to major yearly setbacks.

Disconnected Systems

When loans are managed outside payroll, month-end turns into a reconciliation nightmare.

Cost: Manual syncs consume excessive time, leading to errors and overtime.

Cost: Manual syncs consume excessive time, leading to errors and overtime.

No Visibility = Employee Frustration

Employees don’t know their balance or deduction status. HR fields endless queries.

Impact: Most loan-related queries arise from a lack of transparency.

Impact: Most loan-related queries arise from a lack of transparency.

Compliance Blind Spots

Interest, loan perks, and final settlement adjustments are missed or mishandled.

Risk: Gaps in tax, audit, or full-and-final compliance can cause major yearly setbacks.

Risk: Gaps in tax, audit, or full-and-final compliance can cause major yearly setbacks.

Here’s What You Need

Beehive HRMS Loan Intelligence

A fully integrated loan module inside payroll, where it always should have been.

01

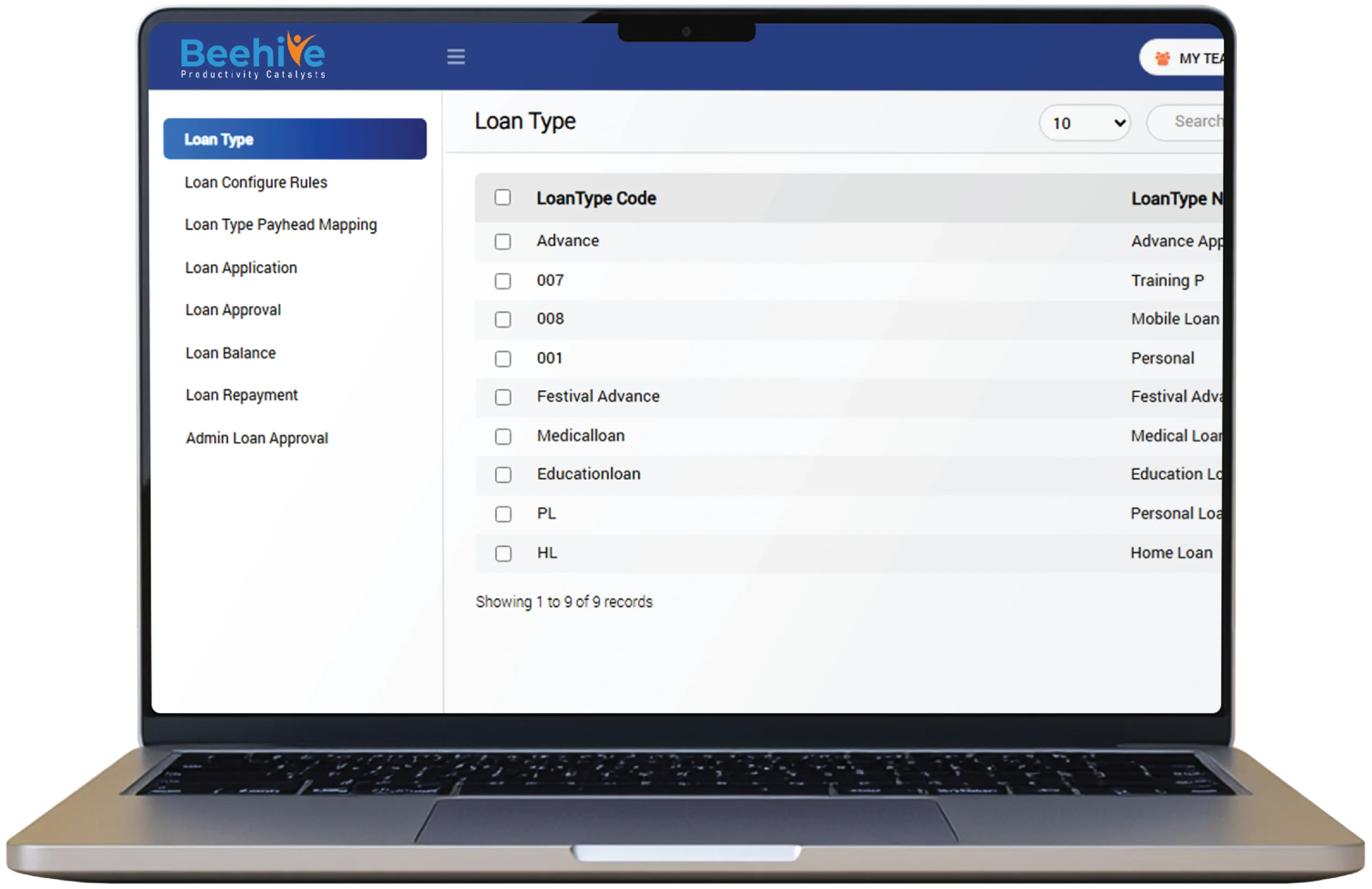

Structured Loan Types, Not Ad-Hoc Entries

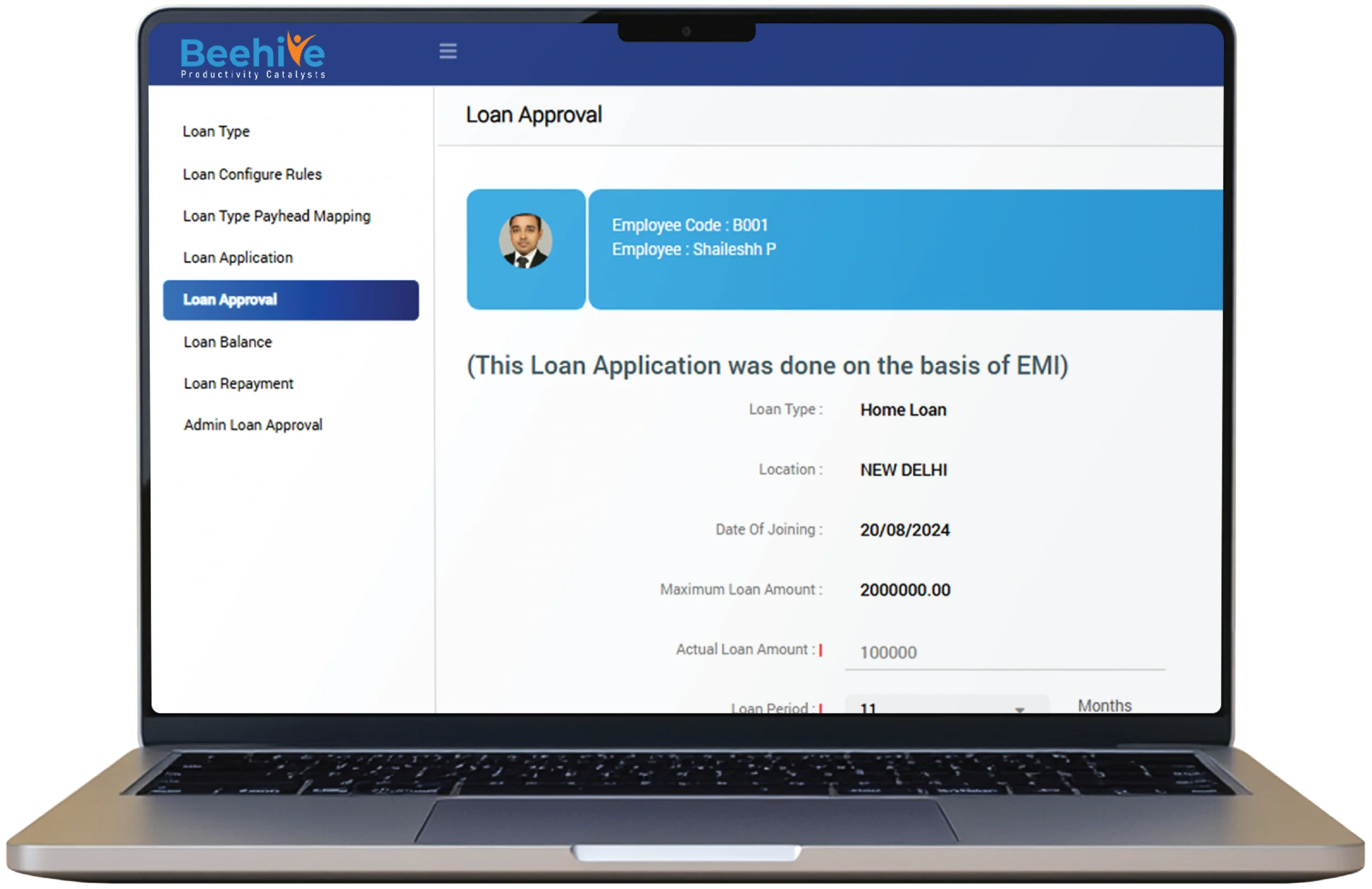

Support advances, festival loans, emergency loans, and more—each with policy-based rules and recovery logic.

Result: 100% policy compliance with zero manual overrides.

Result: 100% policy compliance with zero manual overrides.

04

Final Settlement Integration

Outstanding balances are automatically adjusted in full-and-final settlements during exits.

Protection: Prevents revenue loss and reduces legal exposure.

Protection: Prevents revenue loss and reduces legal exposure.

07

Financial Reports on Demand

Generate ready-to-use reports for finance and compliance teams in a single click.

Benefit: Saves 50+ hours/month in audit and reconciliation prep.

Benefit: Saves 50+ hours/month in audit and reconciliation prep.

Manage Salary Advances Effortlessly, Keep Payroll Accurate

Beehive HRMS Loans & Advances Management turns one of the most error-prone processes into a structured, payroll-integrated system. No manual work. No uncertainty. No sleepless nights during payroll finalization.

Simplify Loans & Advances with Payroll Integration

Beehive HRMS makes managing salary advances, festival loans, and emergency loans easy, transparent, and fully compliant. With automated EMI recovery, policy-based approvals, and payroll sync, it eliminates disputes and ensures trust between employees and employers.

FAQ

What is Loans & Advances Management in Beehive HRMS?

It manages employee salary advances, loans, and repayment schedules digitally.

Can employees request loans through self-service?

Yes, employees can apply online for loans or advances via the self-service portal.

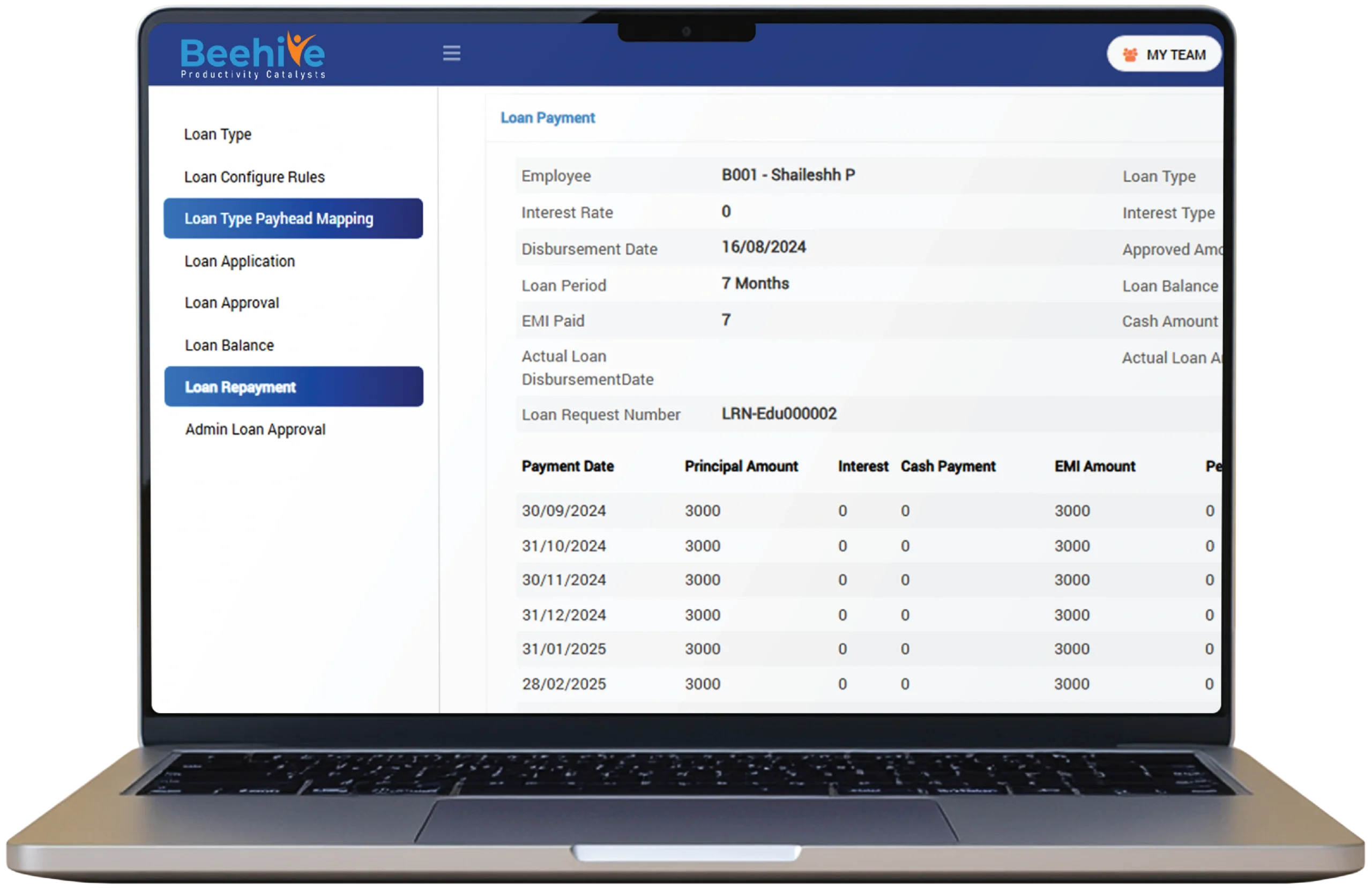

How are repayments managed?

Repayments are automatically deducted from payroll in EMI mode or one-time deductions.

Does it support interest-free and interest-bearing loans?

Yes, Beehive allows configuration of both types of loans with customized rules.

Can HR track outstanding balances?

Yes, HR and finance teams can view real-time loan balances and repayment status.

Is approval workflow available for loans?

Yes, loans and advances follow configurable approval workflows before disbursement.

How does this module improve compliance?

It maintains transparent digital records, ensuring adherence to company loan policies and audit requirements.

Let’s Fix Your Loan Recovery Process Now.

Contact us to learn how.

* Results based on aggregated customer feedback and may vary by organization.